College of Business accounting students lend their talents and gain hands-on experience while helping community members by volunteering to prepare income tax returns. The opportunity allows students to experience the career field of tax accounting.

The Lincoln branch of the IRS Voluntary Income Tax Assistance (VITA) program trains volunteers, including several who spend several Saturdays during tax season helping qualified community members prepare their federal and state taxes at no charge.

“It’s a great experiential learning opportunity for our students,” said Linda Moody, VITA coordinator at the University of Nebraska–Lincoln who has worked with the program since it started in 2003. “They’re gaining life skills learning about their community.”

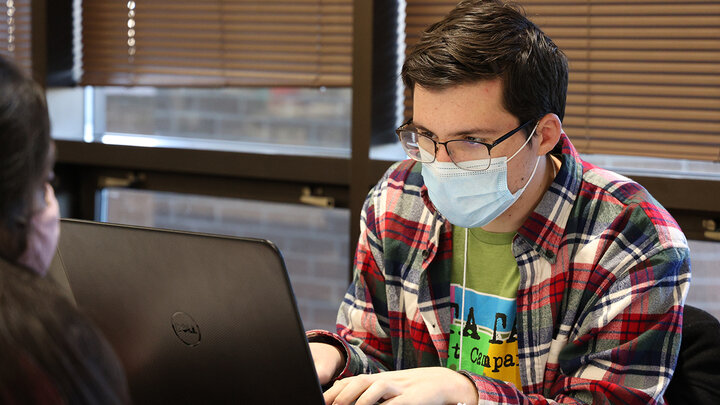

Carson Swartzbaugh, a sophomore accounting and finance major from Omaha, Nebraska, was initially drawn to helping with VITA because it was related to his major. After participating for the first time, he realized how much he enjoyed helping people, too.

“Interacting with the clients has been my favorite part of the VITA experience,” Swartzbaugh said. “Many of the people we worked with expressed their gratitude as many of them don’t have the means to do their taxes on their own. It’s great to see and hear from the people we are helping.”

One student grateful for the tax preparation assistance is Jermaine Kaw, a junior marketing major and international student from Kuala Lumpur, Malaysia. She was nervous two years ago when she learned she needed to file a tax return in the United States, but a fellow international student told her about the VITA program.

“I worried about how to complete my tax return because it was my first time ever filing and I was in a different country. I decided to go to the VITA tax clinic, and they made the experience smooth and explained the process clearly so I could understand every step. It also was free, so I was thrilled to have their help,” she recalled.

About 10 university students typically volunteer for Lincoln VITA each year, including College of Business students, and the need continues to grow as tax laws change and more people qualify for services. The program now serves 2,400 students, families, community members and low-income individuals.

“I’m a huge advocate of service learning, and this connects coursework to real-world needs,” Moody said. “It’s important for our students to participate in VITA not only for that career experience, but also to understand and break down barriers and stereotypes that people might have toward low-income or diverse groups.”

Swartzbaugh’s experience opened his eyes to the many needs in his community and helped him directly apply his skills to something that makes an impact.

“It’s great to get to talk to people from all different walks of life and from places all over the world that all ended up here in Lincoln,” Swartzbaugh said. “It has made me extremely grateful for the opportunities and experiences I gained through this and changed the way I see the world.”

Learn more about the VITA program at https://vita.unl.edu/.

Students interested in volunteering to prepare taxes can contact Linda Moody at lmoody2@unl.edu.