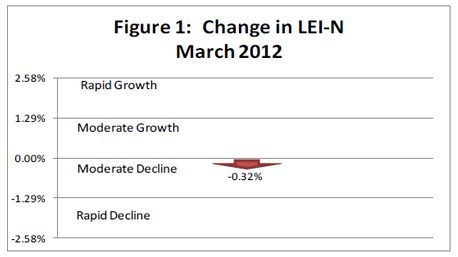

The Leading Economic Indicator for Nebraska declined by 0.32 percent in March, suggesting that the state’s economy will grow slowly in late 2012. The small decline in the monthly indicator followed three consecutive increases between December and February.

Faculty and students in the Department of Economics and Bureau of Business Research within the University of Nebraska-Lincoln College of Business Administration produce the monthly indicators report.

The indicator is a composite of six components that predict future economic growth: single-family building permits, airline passengers, initial unemployment claims, manufacturing hours, the value of the U.S. dollar and business expectations gathered from the

Survey of Nebraska Business.

April Leading Economic Indicator - Nebraska

“A decline in airline passengers and an increase in the value of the U.S. dollar both led to the drop,” said UNL economist Eric Thompson, director of the Bureau of Business Research. The increase in the dollar reduces export activity.

While the aggregate Leading Economic Indicator for Nebraska declined, several components of the index provided evidence of strength in the state’s economy. Respondents to the

Survey of Nebraska Business anticipated an increase in sales and employment over the next 6 months. Also, single-family building permits and manufacturing hours expanded in Nebraska between February and March.

Thompson said that the decline in the indicator in March provides a note of caution about the outlook for the Nebraska economy.

“Leading indicator data from December through February suggested that the Nebraska economy will grow solidly during the late spring and summer of 2012, but the March decline in the leading indicator suggests that growth may stall in late 2012. It will be important to see whether next month’s release confirms this negative trend or whether the leading indicator begins to expand again.”

Published: April 20, 2012